506(b) or 506(c)? What’s the Difference?

Real estate syndicators raise investment capital by issuing securities to investors. Ordinarily, sales of securities must be registered with the SEC (for example, when a company goes public via an initial public offering). However, the SEC provides several exemptions to the registration requirement, including the 506(b) and 506(c) exemptions that Leap Multifamily uses. While these exemptions aren’t the only pathway to a securities offering that is not required to be registered, they’re the ones most commonly used by VC firms and syndicators. This type of fundraising may also be referred to as a private placement (hence the private placement memorandum (PPM) that accompanies each offering) or an exempt offering.

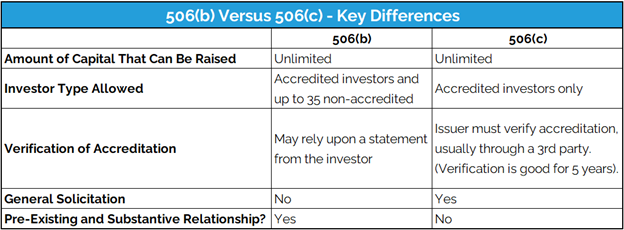

All of our offerings for the foreseeable future will be either a 506(b) or a 506(c) so we’ll focus most of this article on the key differences between those.

Investor Types Allowed (accredited versus non-accredited)

506(b) Offering: Investors may be accredited or non-accredited. Up to 35 non-accredited investors may be accepted per offering and they must qualify as “sophisticated” investors. See below for the definition of accredited investors and sophisticated investors.

506(c) Offering: Investors must all be accredited.

Accreditation Documentation

506(b): Accredited investors may self-attest to their accredited status. No 3rd party verification needed.

506(c): Accredited investors must be verified by a 3rd party. There are several different ways that this may occur and a few of those are listed below. Some investors don’t like the extra step of providing this information but the good news is that this only has to be done once every 5 years as the verification is good for that length of time.

Types of verification to prove accredited investor status:

- Attestation from investor’s CPA

- Reputable 3rd party vendor such as verifyinvestor.com

- An investor can provide specific documents such as a W2 or bank statements to the sponsor

An investor can choose any of these methods for verification, but the first two methods are the most common.

General Solicitation

506(b) offerings are sometimes known as “friends and family” deals as the sponsor must have a pre-existing relationship prior to accepting an investor’s funds into the deal. However, 506(c) offerings may include investors who don’t already have that relationship and as such, the sponsor may use general solicitation as part of their marketing campaign to raise money for the deal. Any type of solicitation is fair game, from social media postings to TV, radio, and newspaper ads.

Glossary

Pre-existing Relationship: A “pre-existing” relationship must be formed before the start of the offering or is established through a broker-dealer or investment adviser prior to that investment professional’s participation in the offering.

Sophisticated Investor: While there isn’t a black and white rule on what constitutes a sophisticated investor, most definitions dictate that investors have sufficient capital, experience, and net worth to judge the merits of potential investments.

Accredited investor: Unlike the definition of a sophisticated investor, there are hard rules for qualifying as an accredited investor.

- Financial Criteria

- Net worth over $1 million, excluding primary residence (individually or with spouse or partner)

- Income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year

Or

- Professional Criteria

- Investment professionals in good standing holding the general securities representative license (Series 7), the investment adviser representative license (Series 65), or the private securities offerings representative license (Series 82)

- Directors, executive officers, or general partners (GP) of the company selling the securities (or of a GP of that company)

- Any “family client” of a “family office” that qualifies as an accredited investor

- For investments in a private fund, “knowledgeable employees” of the fund